There must be an easier way.

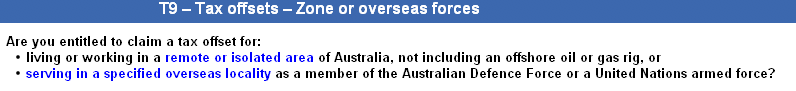

*All* of Australia is remote and isolated, Shirley?

Filled in my Australian tax return yesterday. Those of you who have never had to fill in a tax return don’t know what you’re missing. For the rest of you, I find that at least half a bottle of wine dulls the pain somewhat.

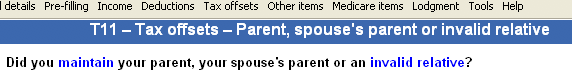

My relatives are perfectly valid, thankyouverymuch

It helps to have a sense of humour. The Australian Tax Office ‘eTax’ software makes the task a little less painful because if you’ve used it in a previous year you can ‘pre-fill’ a lot of information and you get any refund quite a bit faster than if you submit a paper return. The downside is that it only runs in Windows, which (_pace_ Richard Wintle) is quite a large downside, and results in a great deal of swearing at Black Towers as all the anti-virus software whinges about not being updated and what have you.

photographs, he asked knowingly

So we look around for little things to make us laugh. I am, however, a little disappointed that I can’t claim for going to the pictures. But I did shoot some videos of wildlife: does that count do you think?

Oh well. Glad it’s out of the way. And because I left Australia before the end of the tax year there should be a reasonable refund coming my way.

Yay. Makes it all worthwhile.

Almost.

I just had to send a reminder to the tax accountant here in Germany that’s supposed to do the stuff for us – this is the second tax return we’re doing (US tax returns are due in mid-June for ‘expats’).

Yay for getting it done…

I think getting an accountant is a splendid idea.

There is just no way I could have done that myself – the guy has to consolidate the US and German tax returns…

ouch

Steffi, this is the first year I got off my US expat 2555 in April. In fact, it feels like so long ago that I suddenly broke into a cold sweat reading your comment, wondering if I’d actually forgotten to do it.

The Dutch make you fill out a tax form every year even after you’ve left the country permanently! It really pisses me off wasting my time filling up and posting a form with numerous zeroes, but they’ve got my pension hostage, and also, I don’t want to incur the 1000 euro boete (or as we used to call it when we lived there, ‘the big bootie’).

(p.s. the Netherlands is the only nation pretty much anywhere that refuses to let you take your pension with you. They claim this is to protect the pensioner’s ‘rights’, so we can’t be ‘exploited’ by our new host nation. Yeah, whatever.)

Don’t get me started on getting my pension money out of Australia.

You’re supposed to be able to do that online, too.

As if.

Get an accountant. I have a super accountant and he has done my tax returns for many years. He even gave me advice that saved me £££ when I worked in the U. S. and A. for three months. Always bear in mind Belloc’s advice concerning Lord Finchley.

super accountant

Great. I now have a mental image of a square-jawed cove with his underpants on the outside of a pin-striped suit.

The Dutch make you fill out a tax form every year even after you’ve left the country permanently!

Ugh, Jenny – I think that tops it! Can you file a complaint with the UN or something?

Anyone out there reading this that would be interested in setting up an international business taking care of country-hopping scientists’ paperwork – taxes, pensions, moving, registering, etc. – for an affordable fee? Here’s your business idea.

Actually, the DESY, from where I have my initial contract, has an International Office that does this kind of stuff for foreign staff and visiting scientists. I met the lead yesterday, she is absolutely lovely. Too bad I took care of everything myself last year 🙂

Our taxes have been quite straightforward so far, but there will be enough complications (freelance income and a new ability for workmen to claim for certain tools) next time that we might go to an accountant.

There’s no rebate for contributing to the Canadian film industry (does working in it count?), but I’ve always wanted to be able to fill in the box about investing in gold and diamond mine exploration.

I’ve always wanted to be able to fill in the box about investing in gold and diamond mine exploration

Cath, I thought the bit on mineral rights or royalties in oil was cool in the US – until I realized that, in most cases for people who have just inherited a tiny bit of something, that income can actually end up costing them at tax time. Bummer.

@RPG – no need to pacify me, I fully understand the ramifications of filling out Windows-based tax software, believe me.

I knew someone who postdoc’d in Oz, receiving both a Canadian fellowship and a salary top-up from his Australian institute. He filed two tax returns: one in Canada for the Canadian $, claiming the basic personal exemption for the first $8,000 or whatever it was then, and one in Australia for the Oz $, claiming the basic personal exemption or whatever it’s called etc. etc.

One person, two small-ish salaries, two exemptions = small tax load. No idea if this is really legal, mind.

One person, two small-ish salaries, two exemptions = small tax load. No idea if this is really legal, mind.

See, that’s why I need that accountant: there are international tax agreements, and the income in both countries counts in both tax returns in some weird, tax-speak way even though you’ve already paid taxes on it once in the respective other country… oh goodness I’ve bored myself now.

zzzzz

What?

Precisely. Screw taxes.

It’s all so unnecessarily complex. A flat rate on what you purchase (goods or services) would be easier to deal with.

@Jenny: the Netherlands is the only nation pretty much anywhere that refuses to let you take your pension with you

I was living in Oz on a NZ passport and they won’t let me take my pension out of the country either. As the rules stand today (they may well change tomorrow bless) I am not even allowed to transfer it to my NZ pension plan…

Interesting scientific observation though: it turns out that our lounge has an odd time-warp feature to it. There was a five-hour delay in the echoes produced from when I filled out my return to when Richard did his. Incredible, as they were exactly the same…

It’s all so unnecessarily complex. A flat rate on what you purchase (goods or services) would be easier to deal with

Flat tax of 20% on income all round, rich or poor. It’s so simple, would save the gummint a zillion jobs and no end of trouble. So simple, so equitable, but even the Tories have buried it.

Jenny, I don’t have to file taxes in Holland anymore. There’s some kind of tax treaty so that I only have to file in either Canada or Holland, and they somehow figure out between them what happens with the money.

Next up: the 2009 Tax War between Canada and the Netherlands.

It all started in a little town you’ve probably never even heard of…

I’ve heard it said that a flat income tax would have to be at such a high rate that people would rebel. If true, I guess it’s the really high tax rate on the really rich that is supporting the whole works, which doesn’t necessary sound right either.

@RPG – the Netherlands still sends us flowers every year for deeds performed in WWI. We get along famously.

WWII.

see, I find it all interesting since the Swedish tax form is super simple (unless you have a small company or are a one person business because then it is complex to say the least) – the IRS send you a form with all numbers already in…. and you just sign it. Then again, one could say something about it all being like that because all files and documents are kept by the government and we are totally controlled……

Here in the US I must admit that it wasn’t too hard to do my taxes, mostly maybe because I had to do them for day 1 rather than many on a visa who can work for 2 years without paying federal tax… Sweden doesn’t have tax treaties with US – or many other countries for that matter….

I don’t want to contemplate the pension issue at all…. I am hoping for a lottery win or dying before it is suppose to kick in since it will be nothing for me there. (almost true, but who knows what happens in 30 years?)

The UK really does have its act together tax-wise for most people. It’s just when you’re slightly odd (doing non-PAYE work, essentially) that ordinary folk have to worry.

You can’t have a flat rate of tax because (a) it puts a burden on the low paid (no tax-free allowance) and (b) millions of civil servants will lose their jobs.

Not sure about (a), but (b) wouldn’t necessarily be a bad thing.

I wasn’t necessarily claiming it would be.

I thought you were iFree this weekend, Henry? Am I still in charge?

I hear the Argentinian system is the most fun. You have to submit all of your receipts for absolutely everything that you needed in order to live, housing, bills, food etc and then they only tax you on what was left…dare I say it…probably why the country is so poor, how many people must be needed to read all the receipts and forms.

Yegods. Not to mention the potential for abuse.

I thought you were iFree this weekend, Henry? Am I still in charge?

Just testing. Very good responses, Grant. Carry on.

Sah! Thank you, sah!

Holy Unicycling Giraffes, Batman – how did I miss this ScienceOnline’09 – Interview with Henry Gee

Please… don’t do that.

I’m back now, Grant. You may stand down.

Who are you again?

Haven’t the faintest. Ask my wife. She might know.

I suspect Inland Revenue could tell you who Henry is, although it might take a long time.

@Eva – yes, WWII of course, although I suspect rather a lot of our boys were tramping through The Netherlands in WWI as well. I should know more about this than I do, unfortunately.

Hah. The ATO coughed up in rather a splendid fashion.

I can afford to eat for the rest of the week.

… but only kangaroo-burgers, and then only every other Wednesday (in the Town Hall, if wet; restrictions may apply)

Damn.